Inspired to write the post by the (incredibly shallow) program on channel 4 on Monday 10 July.

We all like simplicity. It is probably one of the things that defines us as a species, you never hear anyone say “this is too easy we need to make it more complex”. Intellectually we have designed mathematical theories which cover the decision-making process, the impact on demand of changing prices or even how long we will live (if you believe the actuarial tables). Retirement is no different and specifically the math that was quoted in the program was that “in order to retire early you need to save 25 times your annual expenses”.

That’s a scary statement as it went on to say that if your annual expenses are 25,000 then you need 625,000 to retire. I imagine that the vast majority of people switched off at that point as a report by Aegon indicated that the average 55 year old (never mind 40 year old) has around 50,000 in pension savings and 2 in 5 households have no savings at all.

That’s a scary statement as it went on to say that if your annual expenses are 25,000 then you need 625,000 to retire. I imagine that the vast majority of people switched off at that point as a report by Aegon indicated that the average 55 year old (never mind 40 year old) has around 50,000 in pension savings and 2 in 5 households have no savings at all.

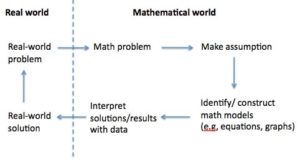

The problem with mathematical theories of course is that they rarely, if ever, have a real world application. Trust me, three years at university studying economics, only to emerge to the world with no real skills teaches you this.

But as the saying goes, anything that’s worth having is worth working for so it at least merits investing a little bit of time to understand the principles.

So let’s dig a little deeper into the math (and for those who want to play along you may want to use this nifty calculator. We’ll talk about a couple of the complexities of this model but the basics are very straightforward. You need to know the following:

- How much money you take home annually

- How much your annual expenses are

- The investment return on your savings

The calculator will then work out based on your current savings rate when you can retire. Ok? Simple! …..and a little scary, because if you put in annual take home pay of 20,000 and annual expenses of 19,500 then it looks like around 85 years to reach retirement (which by the way corresponds to current savings rate in the UK). But if your annual take home pay is 30,000 and your expenses are 15,000 then great, you’re on track to retire in 16 years.

The math is not too complicated (and the calculator does it all for you anyway) but let’s start with some of those assumptions.

Firstly, the model assumes an annual inflation adjusted investment return of 5% which, if inflation is at 3%, means you need to achieve 8%. Of course you won’t find any savings accounts paying 8% at the moment which means you are going to need a portfolio of investments which might give you both income (perhaps in the form of dividends and interest) and investment growth.

Firstly, the model assumes an annual inflation adjusted investment return of 5% which, if inflation is at 3%, means you need to achieve 8%. Of course you won’t find any savings accounts paying 8% at the moment which means you are going to need a portfolio of investments which might give you both income (perhaps in the form of dividends and interest) and investment growth.

Although the investment world may seem incredibly complex (and by the way it certainly can be!), today it’s possible to build a diversified portfolio with just one or two well-chosen investments. Whether you can achieve the 8% growth on average (because remember that investments tend to be long-term and sometimes volatile) may be a different question and again one which we will touch on in a future post. However, the key message is that if you leave you money in a regular savings account (the modern day equivalent of the mattress), then it’s likely to derail the “25 times you annual expenses” argument.

Secondly, you need to look at your expenses. There are numerous blogs and websites out there which talk about frugal living, how to save money and how to cut back on your expenditure so I won’t repeat a lot of that here. My point would be that you actually need to track your expenses (on a spreadsheet, an app or even a little dog-eared notepad) but the important thing is you actually need to do it so you know what your real expenses are, not just what you think they ought to be! Just like dieting where it’s easy to ‘forget’ to write down the doughnut you had with your morning coffee, it’s the same with expenditure where it’s easy to ‘forget’ to write down the little weekend away or weekly takeaway (using the justification that it’s not part of your normal expenses). Be honest. Of course it’s quite legitimate to tweak your current expenditure as you’ll hopefully be spending less on work related things (transport, clothes etc.) but maybe more on leisure and travel.

Secondly, you need to look at your expenses. There are numerous blogs and websites out there which talk about frugal living, how to save money and how to cut back on your expenditure so I won’t repeat a lot of that here. My point would be that you actually need to track your expenses (on a spreadsheet, an app or even a little dog-eared notepad) but the important thing is you actually need to do it so you know what your real expenses are, not just what you think they ought to be! Just like dieting where it’s easy to ‘forget’ to write down the doughnut you had with your morning coffee, it’s the same with expenditure where it’s easy to ‘forget’ to write down the little weekend away or weekly takeaway (using the justification that it’s not part of your normal expenses). Be honest. Of course it’s quite legitimate to tweak your current expenditure as you’ll hopefully be spending less on work related things (transport, clothes etc.) but maybe more on leisure and travel.

Thirdly, I am glad that the program spent a little time talking about people who have taken ownership of the top line of the equation, income. While not everyone has the motivation, ideas or capital to start a successful business (such as sending messages on potatoes – genius), most people have some skills or abilities which they do not make the most of. That might be looking for new opportunities or promotion at your existing or a new employer, starting a little sideline such as proof reading or painting model soldiers (actual jobs people I know have been done), or maybe even taking a second job. If you’re committed to early retirement this might be the most important way to reduce your ‘time to retirement’ as you can only cut your expenses so far before you become a baked-bean eating hermit and investment returns are to a large extent out of your control (although investment mix is not).

Let’s also not forget that that any mathematical theory is never an absolute, just as there is a statistical possibility of you winning the lottery there is a probability that you will not! And it’s the same with retirement planning, investment returns are not linear and neither are expenses so in all likelihood you will need some sort of buffer to cover uncertainty. How much buffer will depend on things like attitude to risk or whether you could realistically jump back into work if it does not work out. .

Finally, if all the above looks and sounds a little complicated and a little too hard, there is some good news. Firstly, the calculator does not explicitly include income from pensions but both work place pensions and your state pension should form part of your savings assumption. Secondly, and more importantly, the calculator assumes that retirement is funded without drawing on any of the capital i.e. all retirement expenses are funded through investment returns whereas in reality most people will draw down on at least some of their capital through retirement. How you predict how much you can do that without running out of money is another story.

Finally, if all the above looks and sounds a little complicated and a little too hard, there is some good news. Firstly, the calculator does not explicitly include income from pensions but both work place pensions and your state pension should form part of your savings assumption. Secondly, and more importantly, the calculator assumes that retirement is funded without drawing on any of the capital i.e. all retirement expenses are funded through investment returns whereas in reality most people will draw down on at least some of their capital through retirement. How you predict how much you can do that without running out of money is another story.

So, what should we conclude? To some extent titling a television program “can you retire at 40” is a little bit moot, rather it might have been more helpful had the program been titled “the three things you need to think about if you want to retire early” but I guess that’s less headline grabbing. The math is irrefutable and there are many commentators out there who will talk through that math far more eloquently and in detail that I have. But mathematical theories tend to get messed up by real people making life decisions based on a series of unknown (and unquantifiable) factors such as why do you want to retire? What sort of retirement you want? And what will you do with all that free time? Those are the more philosophical questions that are more difficult to cover in a 30 minute TV program. Fear not – we will cover this in the blog!